All Categories

Featured

Table of Contents

An additional sort of benefit credits your account equilibrium periodically (annually, for instance) by establishing a "high-water mark." A high-water mark is the highest value that a mutual fund or account has actually gotten to. After that the insurer pays a death benefit that's the higher of the existing account value or the last high-water mark.

Some annuities take your preliminary investment and instantly include a particular portion to that quantity yearly (3 percent, for instance) as an amount that would be paid as a fatality advantage. Variable annuities. Recipients after that receive either the real account value or the initial financial investment with the annual increase, whichever is greater

For instance, you could pick an annuity that pays out for one decade, however if you die prior to the 10 years is up, the staying settlements are assured to the recipient. An annuity survivor benefit can be helpful in some scenarios. Below are a couple of examples: By assisting to prevent the probate procedure, your recipients may get funds quickly and conveniently, and the transfer is personal.

How can an Tax-deferred Annuities protect my retirement?

You can generally select from several options, and it's worth exploring every one of the choices. Choose an annuity that functions in the means that best assists you and your household.

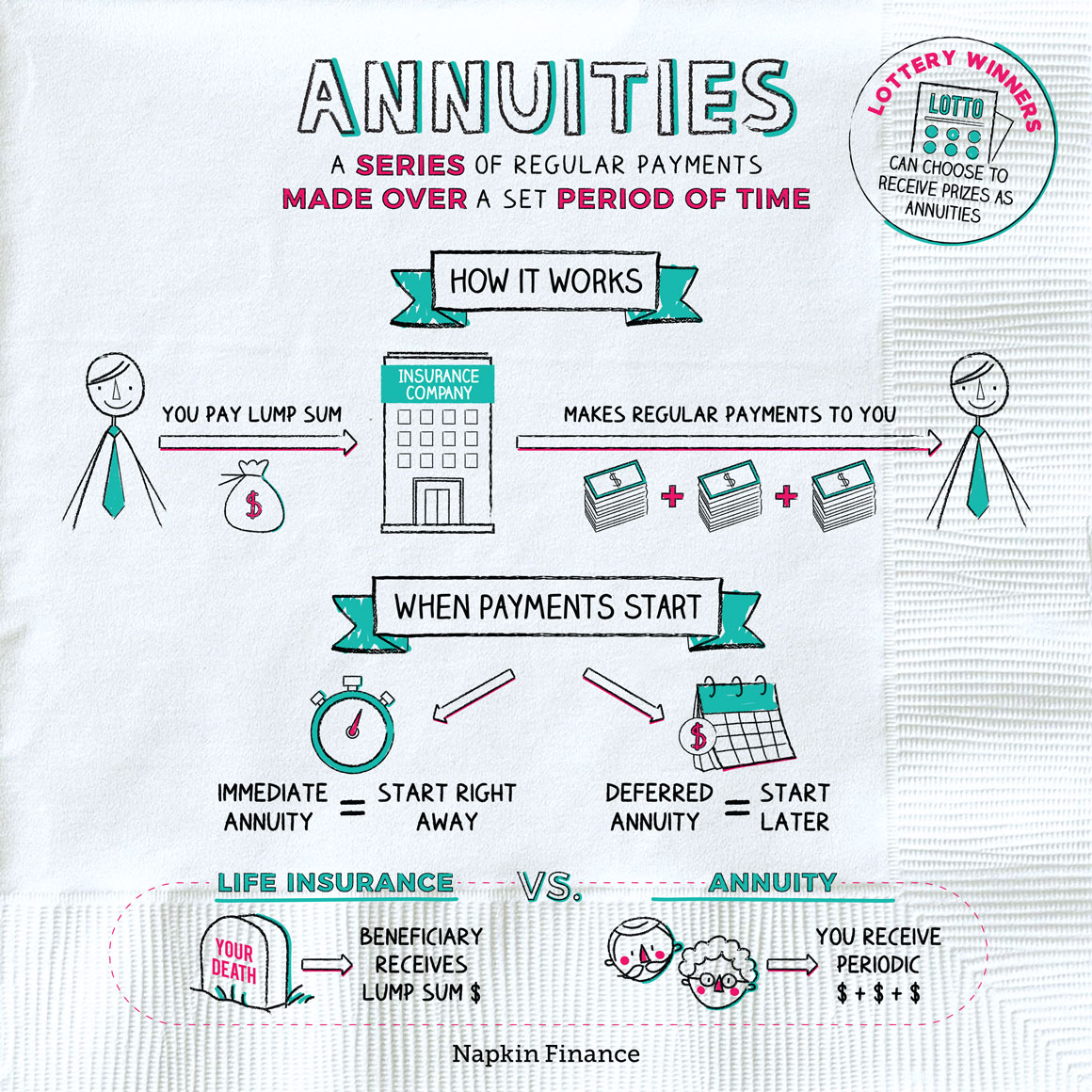

An annuity helps you build up money for future revenue requirements. The most ideal use for earnings settlements from an annuity contract is to money your retired life. This overviewneed to be made use of primarily to aid you make options when getting an annuity and to help you recognize annuities as a source of retired life income.

This material is for educational or academic functions only and is not fiduciary financial investment recommendations, or a securities, investment method, or insurance policy item recommendation. This product does not take into consideration an individual's own purposes or scenarios which must be the basis of any type of investment choice (Secure annuities). Financial investment items may go through market and various other risk elements

How do Annuities For Retirement Planning provide guaranteed income?

Retired life payments refers to the annuity earnings received in retired life. TIAA might share earnings with TIAA Typical Annuity proprietors through declared extra quantities of rate of interest during build-up, greater initial annuity revenue, and through further rises in annuity revenue advantages during retirement.

TIAA may give a Loyalty Bonus offer that is only readily available when electing lifetime revenue. The quantity of the benefit is optional and figured out annually. Annuity contracts might include terms for keeping them in force. We can give you with prices and full information. TIAA Typical is a fixed annuity product provided with these contracts by Educators Insurance policy and Annuity Organization of America (TIAA), 730 Third Method, New York City, NY, 10017: Form series consisting of but not limited to: 1000.24; G-1000.4; IGRS-01-84-ACC; IGRSP-01-84-ACC; 6008.8. Not all agreements are readily available in all states or currently released.

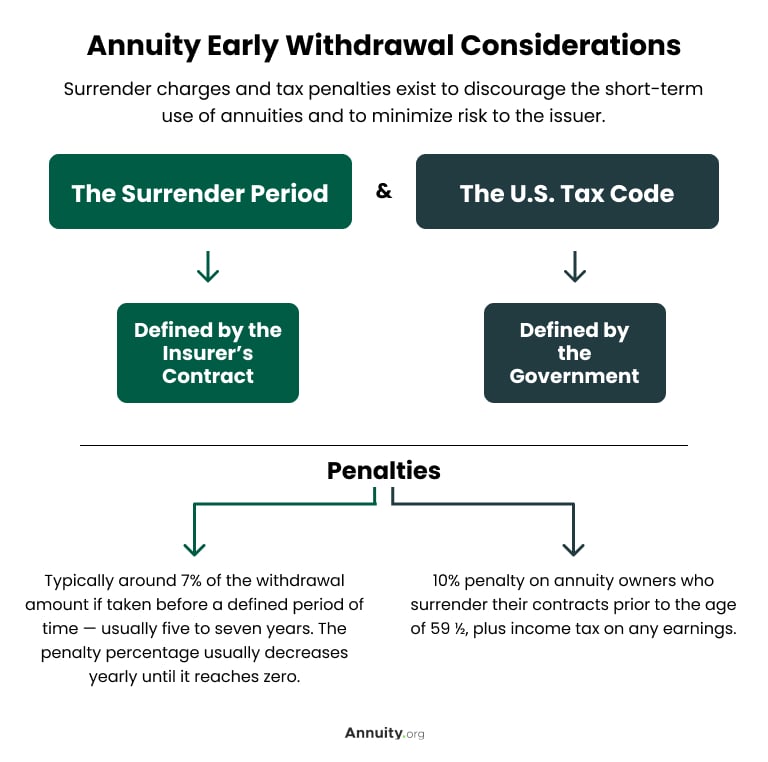

Converting some or all of your savings to revenue advantages (referred to as "annuitization") is a long-term choice. When income benefit payments have started, you are not able to transform to one more choice. A variable annuity is an insurance coverage contract and consists of underlying investments whose value is tied to market efficiency.

Annuity Income

When you retire, you can select to receive income forever and/or other income choices. The property market undergoes numerous dangers consisting of variations in underlying residential property values, costs and income, and potential environmental liabilities. In basic, the worth of the TIAA Property Account will certainly vary based on the hidden value of the straight property, genuine estate-related investments, actual estate-related safety and securities and fluid, set income financial investments in which it spends.

For a much more complete discussion of these and other risks, please consult the syllabus. Responsible investing incorporates Environmental Social Administration (ESG) variables that may affect exposure to issuers, fields, markets, limiting the kind and number of investment opportunities offered, which might cause leaving out financial investments that do well. There is no assurance that a diversified portfolio will certainly improve general returns or surpass a non-diversified profile.

Aggregate Bond Index was -0.20 and -0.36, specifically. Over this very same duration, connection between the FTSE Nareit All Equity REIT Index and the S&P 500 Index was 0.77. You can not spend straight in any kind of index. Index returns do not reflect a reduction for charges and expenses. Other payment alternatives are readily available.

There are no costs or costs to launch or stop this attribute. It's crucial to note that your annuity's equilibrium will certainly be lowered by the revenue settlements you obtain, independent of the annuity's performance. Income Examination Drive revenue settlements are based upon the annuitization of the amount in the account, period (minimum of ten years), and various other aspects chosen by the participant.

Where can I buy affordable Annuities?

Any warranties under annuities released by TIAA are subject to TIAA's claims-paying capacity. Transforming some or all of your savings to revenue benefits (referred to as "annuitization") is a permanent choice.

You will certainly have the alternative to call numerous beneficiaries and a contingent beneficiary (a person assigned to receive the money if the primary recipient dies before you). If you do not call a beneficiary, the accumulated properties might be surrendered to a financial institution upon your fatality. It is necessary to be knowledgeable about any monetary effects your beneficiary may face by inheriting your annuity.

Your partner can have the option to alter the annuity agreement to their name and come to be the new annuitant (understood as a spousal extension). Non-spouse recipients can't continue the annuity; they can only access the marked funds.

Annuity Income

Upon fatality of the annuitant, annuity funds pass to an appropriately named recipient without the hold-ups and prices of probate. Annuities can pay fatality advantages a number of different methods, depending on terms of the agreement and when the death of the annuitant takes place. The option chosen effects exactly how tax obligations are due.

Choosing an annuity recipient can be as complicated as picking an annuity in the first location. When you speak to a Bankers Life insurance coverage agent, Financial Rep, or Investment Consultant Agent that supplies a fiduciary requirement of care, you can relax assured that your decisions will certainly assist you develop a strategy that provides safety and peace of mind.

Table of Contents

Latest Posts

Analyzing Immediate Fixed Annuity Vs Variable Annuity A Comprehensive Guide to Investment Choices What Is Pros And Cons Of Fixed Annuity And Variable Annuity? Advantages and Disadvantages of Deferred

Breaking Down Variable Vs Fixed Annuities Everything You Need to Know About What Is A Variable Annuity Vs A Fixed Annuity Breaking Down the Basics of Investment Plans Pros and Cons of Various Financia

Breaking Down What Is Variable Annuity Vs Fixed Annuity Key Insights on Pros And Cons Of Fixed Annuity And Variable Annuity Defining the Right Financial Strategy Advantages and Disadvantages of Fixed

More

Latest Posts